| By Kimberly Kim |

Q1: Is there any interest from Chinese buyers to purchase US olive oil?

The Chinese middle class is booming and imports of foreign products continue to grow. Chinese consumer market interest in foreign olive oil has experienced an increase in recent years. As more and more Chinese consumers start to appreciate foreign food, especially salads, Chinese imports of olive oil will most likely continue to increase in the coming years.

By far the most imports of olive oil are coming from Spain, which takes more than 80% of the market in China.

80% of the olive oil is consumed in first-tier cities like Shanghai and Beijing. This doesn’t come as a surprise as these cities are more developed, with people who have more money and a stronger desire to try out Western products.

Chinese consumers mainly prefer extra-virgin oil. Pricing your products at a higher level might not necessarily adversely impact sales, especially as cross-border sales tend to have high logistics costs.

Q2: Is there an agency or business consortium in China sellers can contact that buys US olive oil?

Chinainout is a leading and professional platform for foreign manufacturers to promote business in China.

http://oliveoil.chinainout.com is a website specifically designed for olive oil products, however most of the information on this site is about companies from Spain, Italy, Greece, Tunisia, Turkey, Syria, and Morocco. Initial review of the site shows no information regarding American olive oil companies currently selling in China.

There are also business directories for sale online which include olive oil import/export company introductions and contact information. The olive oil bottle prices range from 280 RMB—7800 RMB ($40 USD — $1100 USD).

Q3: Do buyers in China prefer to purchase in large volume containers (1-liter, 2-liter, 5-liter, or larger) or 250ml and 500ml bottles?

750ml is the most popular size since olive oil products are consumed as gifts in China. Also, they often come with well-made giftable boxes. 1-liter and 5-liter are also popular sizes for household use.

Q4: Who is responsible for import licenses? Are import licenses handled by the buyer in China or seller in the US?

Buyers are responsible for import licenses.

Q5: What is the market price for gourmet olive oil in China?

The following table shows the top 10 olive oils available in the Chinese market, according to sales in Tmall by Alibaba.

|

Brand: Betty VallandPrice: 115RMB ($16.4 USD) 5LMade in China, Fujian Province20,000 bottles sold per month |

|

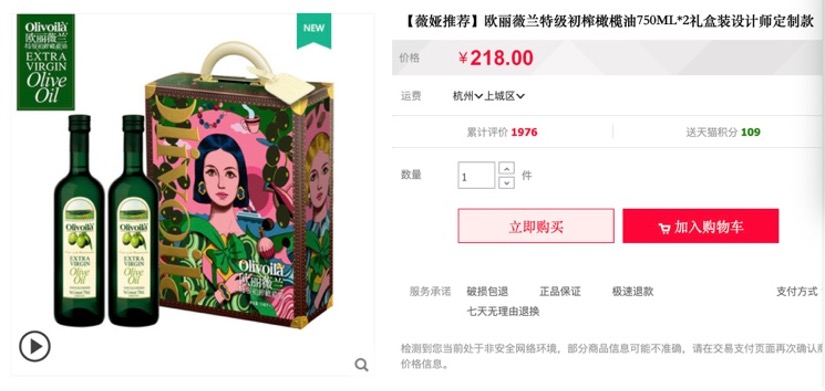

Brand: OlivoilaPrice: 218 RMB ($31.1 USD) 750ml*2 Made in China, Shanghai, 10,090 bottles sold per month |

|

Brand: Theotu Price: 49 RMB ($7 USD) 750ml, Made in Spain9,500 bottles sold per month |

|

Brand: OlivoilaPrice: 165.60 RMB ($23.5 USD) 1.6LMade in China, Shanghai6,000 bottles sold per month |

|

Brand: BellinaPrice: 99RMB ($14.1 USD) 750ml, Made in Spain4,722 bottles sold per month |

|

Brand: Theotu, Price: 198 RMB ($28.2 USD) 750ml*2Made in Spain4,713 bottles sold per month |

|

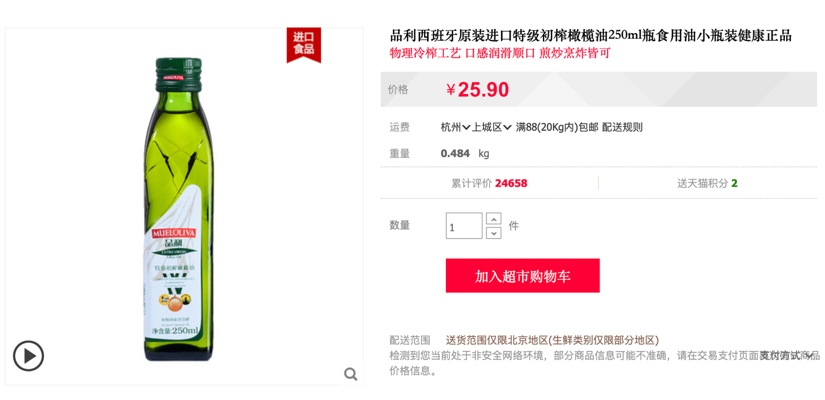

Brand: MuelolivaPrice: 25.9 RMB ($3.9 USD) 250mlMade in Spain4,266 bottles sold per month |

|

Brand: BetisPrice: 48 RMB ($7 USD) 250mlMade in Spain3,854 bottles sold per month |

|

Brand: OlivoilaPrice: 165 RMB ($23.5 USD) 750ml*2 Made in China, Shanghai3,388 bottles sold per month |

|

Brand: BetisPrice: 258 RMB ($36.8 USD) 500ml*2Made in Spain3,339 bottles sold per month |

Q6: Are there any other fees or licenses required to sell olive oil to buyers in China?

Information, Procedures and Tariffs Required to Import Olive Oil

A. Qualifications required by domestic consignees (companies) of olive oil imports:

- Food business qualification or food circulation license

- Import and export rights

- Automatic import license

B. Information required for edible oil import declaration:

- The official certificate of origin

- Official health certificate of producing country

- Manufacturer’s ingredient list

- Manufacturer’s product inspection report

- Proof that the product is registered and approved for sale in its country (region)

- One copy of the original packaging label sample and three copies of the Chinese and English label sample

- The official quarantine certificate of the quarantine manufacturer

C. Proof/license documents need to be provided before import

- The official certificate of origin

- Official health certificate of producing country

- Manufacturer’s ingredient list

D. Olive oil import duty rate:

| Import tariffs | VAT | Comprehensive tax rate | |

| Virgin olive oil | 10% | 13% | 24.3% |

| Extra virgin olive oil | 10% | 17% | 28.7% |

E. Olive oil import declaration process:

- Sign contract

- Replacement order

- Customs declaration pre-record

- Three inspections: Commodity, animal and plant, and sanitary inspections

- Sampling and submission inspection (if randomly selected)

- Customs document release and tax release form*

- Tax payment

- Customs inspection (if randomly selected)

- Customs electronic release

- Delivery of goods

Q7: Is it sustainable to sell olive oil via cross border e-commerce?

Cross border e-commerce can be a very successful business model. There are many companies that have succeeded immensely this way.

But the Chinese government has started to clamp down on cross border sales due to issues with everything from salmonella contamination to expired products.

China has also introduced a Positive List. Only products that fall into one of the categories on the Positive List can be imported into China through a cross-border eCommerce model.

In April 2016, China issued two versions of the “Positive List” for cross-border eCommerce, with the more complete version listing a total of 1,293 categories of products. This list was updated in 2018, taking that total to 1,321 product categories.

Fortunately, olive oil is included in the positive list, falling under the following tariff codes and descriptions:

15091000 Virgin olive oil

15099000 Refined olive oil

15100000 Other olive oils

Q8: Any other helpful information to successfully sell US olive oil to Chinese buyers?

If you plan to sell online in China, you have two main options:

- Sell the products both in-country and online. Selling in-country and on websites like Tmall will give you exposure to around 550 million consumers.

- Sell via cross border e-commerce, on websites like Tmall Global, avoid lengthy registration processes, and have lower costs. This is a fast track option for initial sales into the Chinese market.

The second option gives you exposure to around 100 million consumers and is recommended for companies that are less experienced in the Chinese market.

Summary

Olive oil is becoming increasingly popular in China where Spain is the biggest exporter, contributing to more than 80% of the market. Italy, Greece, and Turkey are seeing increased sales of olive oil in China.

Selling via cross border e-commerce is easier and less costly compared to traditional imports, as international companies don’t currently need to register with local authorities, provide test reports, or comply with the China Guobiao (GB) national testing certification standards.

Sources:

Information, Procedures and Tariffs Required to Import Olive Oil: China Customs

Positive List Helper: https://www.tmogroup.asia/china-positive-list/

*Imported olive oil customs clearance supervision certificate 7A. 7 refers to automatic permit; A refers to inbound cargo clearance form. Submit the certificate of origin of the exporting country and file it on the consignee’s website at ire.customs.cn

This report was researched and prepared by Kimberly Yinhua Kim, International Business Development Specialist at Intelliwings

For more information, please contact info@intelliwings.com