Afghanistan’s Lithium and China’s EV Ambitions

| By Barry Yao |

China Finds Promise and Peril in Potential Afghan Investment

China is today’s largest electric vehicle manufacturer. According to estimates, China alone manufactured 70% of the world’s EVs in 2024. As a result, China has become the world’s largest purchaser and processor of lithium, a critical component of lithium-ion batteries that are used in EVs. Last year alone, China reportedly imported about 235,000 tons of lithium carbonate, up from 2023’s 158,749 tons, to meet the needs of its rapidly growing electric vehicle industry.

China’s lack of domestic lithium deposits means that the country is heavily reliant on imports to meet its growing domestic demand. One country China imports lithium from is Australia: the world’s largest producer of lithium, which exports almost all – 96% – of its production to Beijing. The short distance between the two countries compared to China and Chile, another major lithium producer, makes Australia and China the world’s largest lithium trade relationship.

However, as China’s companies diversify their lithium sources and reduce potential risks, they do not have to look far to find a potential new trading partner: Afghanistan.

Afghan Lithium Could Cut Chinese EV Production Costs

Although Afghanistan’s mineral wealth remain largely untapped after decades of conflict and crumbling infrastructure, the return of the Taliban regime has attracted China’s interest in potentially investing in the country’s critical mineral sector. According to the US Geological Survey, Afghanistan is believed to have a sizable amount of lithium deposits that rival those of Bolivia, home to one of the world’s largest reserves. As Afghanistan experiences its economic crisis, questions are now raised about the possibility of taking advantage of its unexploited deposits. And as global demand for batteries, smartphones, and other electronics grows, Afghanistan’s lithium deposit can potentially be an economic lifeline.

For China’s battery companies such as CATL, BYD, and Gotion High Tech, sourcing lithium from a neighboring country would not only reduce transportation costs but also improve supply chain continuity. Shorter shipping distances would mean that Chinese companies’ input costs are lower, and EV production turnaround would be faster. Securing mining rights in Afghanistan would not only reduce Chinese companies’ vulnerability to global supply chain disruptions but could also reduce the shocks from foreign exchange market instability.

Seeking Stability Amid Currency, Trade, and Price Volatility

Although the trend of using the U.S. dollar is declining, the dollar is still dominant in bilateral trade between China and other countries. Bilateral lithium trade between China and Australia, Chile, and Argentina is done in U.S. dollars, so Chinese buyers are subjected to foreign exchange rate risks and commodity price volatility. Should the Chinese renminbi weaken against the U.S. dollar, Chinese companies’ cost of purchasing the same amount of lithium would drastically increase; and small-margin industries such as battery production could see severe cost overruns. On the other hand, lithium’s price volatility also presents obstacles for Chinese companies’ long-term planning.

Therefore, if China were to source lithium from Afghanistan, the renminbi would very likely become the dominant denominating currency of their bilateral trade, shielding Chinese firms from foreign exchange rate currency swings. Furthermore, due to close distance and investment, Chinese involvement in mineral extraction would see the country exert more control over costs and pricing, further insulating battery-producing firms from supply sourcing volatility.

China’s Infrastructure Development and Resource Investment Model

Chinese investments in Afghanistan’s mining industry would be accompanied by the Chinese government’s infrastructure development strategy to link logistic routes between the two countries. This follows China’s resource for infrastructure model in which loans for infrastructure development are repaid with natural resources. China has implemented this strategy in regions such as Sub-Saharan Africa, where Chinese banks provide loans for infrastructure investment and recover costs through the profits from mining operations.

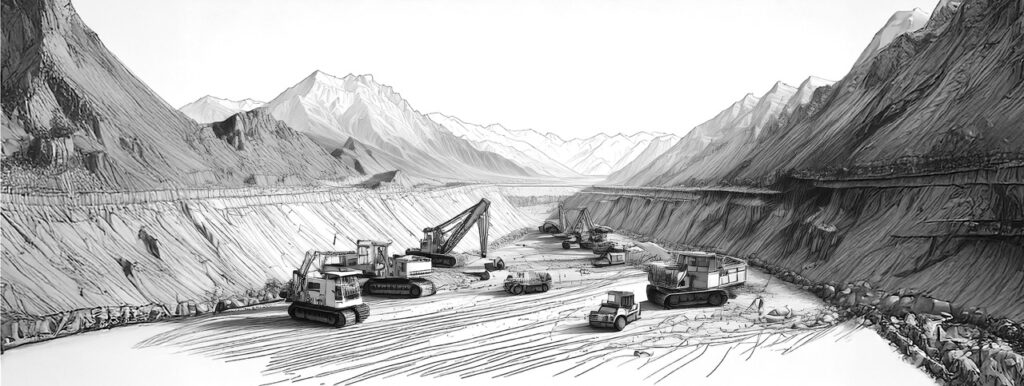

Afghanistan’s rugged geography and crumbling infrastructure, from decades of conflict and corruption, would present a challenge and require significant government investment to build transport infrastructure through the Wakhan corridor. Therefore, mining projects would move alongside government infrastructure financing, ensuring stable mining operations and incorporating Afghanistan into China’s global lithium supply chain.

Access to Afghanistan’s lithium deposits would also allow Chinese firms to secure long-term supplies at a time of increasing lithium demand. Global electric vehicle sales are expected to rise to 40 million by 2030 and 64 million by 2035; this surge will put pressure on lithium prices and supplies. Afghanistan’s mineral resources can help Chinese firms stabilize costs while meeting demand, sustaining its competitive EV export pricing. It would further strengthen China’s leadership in the global green energy market reinforcing its market advantage over competition from Western automakers.

Chinese Moves, Western Responses

Already viewing lithium as a critical raw material, the United States and the European Union would see China’s investment in Afghanistan’s lithium sector as further consolidation of Beijing’s dominance in EV supply chains, and potentially eclipse or jeopardize western supply chains. Concerned that Afghanistan would become another node in China’s expanding lithium network, Washington and Brussels would deepen lithium friendshoring, shifting supply chains toward geopolitical allies. The US and EU would likely boost trade with Argentina, Chile, and Australia and expand incentives for their domestic mining operations.

At the same time, a tariff on Chinese lithium batteries would signal the US and the EU’s intention to decouple from China on lithium supply chains, as well as an attempt to insulate their EV sectors from Chinese leverage. A Chinese push to gain access to Afghanistan’s mineral resources would see the US and the EU further diversifying their supply chains and to reinforce strategic independence.

Looking Beyond Lithium, China Eyes Broader Afghan Opportunities

On August 20, 2025, Chinese Foreign Minister Wang Yi traveled to Kabul to discuss with Afghan officials China’s willingness to initiate mining operations in the country. Wang said that China is willing to cooperate with Afghanistan in areas such as trade and agriculture. Wang Yi’s visit also comes at a time when Afghanistan is actively courting international investors and securing a critical revenue stream in a time of economic crisis. Reduction in foreign aid, restriction on banking and trade, and desperate economic conditions have resulted in high unemployment of 13.3%, a figure further exacerbated by the mass dismissal of government employees. Therefore, Chinese investment into Afghanistan could serve as a job creator in a country labeled one of the poorest in the world.

Lithium in the Graveyard of Empires: China’s Challenges in Afghanistan

The opportunities in Afghanistan’s vast mineral reserve are offset by international politics. For many investors, the reputational jeopardy of engaging with an internationally unrecognized Taliban regime acts as a major deterrent to potential business investments. International sanctions can also keep away investors as firms would risk critical relationships with other nations, making any potential engagement a self-defeating exercise. Furthermore, profound domestic security problems, exacerbated by ISIS-K’s terrorism activities, renders potential investment a highly risky endeavor.

China’s strategy to remain the world’s leader in the electric vehicle industry hinges on a diverse, low-cost, and stable lithium supply chain – an advantage Afghanistan can enable. The prospect of protections from foreign exchange risk and price volatility makes Afghanistan highly appealing for Chinese investors. Yet, extreme insecurity and international sanctions makes investment a challenging enterprise. In short, China’s potential investment into Afghanistan’s lithium mining operations and its lucrative economic opportunity faces formidable political and security headwinds.

The images in this article were created using an AI image generator. All illustrations are ©Intelliwings.