How The US-EU Trade Deal Will Reshape the Global Energy Market

| By Olivia Ernst |

US-EU Trade Deal Overview

On July 27, 2025, United States President Donald Trump and European Commission President Ursula von der Leyen announced a new US-EU trade deal. The deal primarily focuses on establishing a 15% tariff ceiling on EU exports to the US, requiring the EU to remove tariffs on US imports of capital goods. A key component of the agreement is its impact on the EU’s energy purchases. According to a White House fact sheet, the deal requires the EU to spend $750 billion on US energy imports over the next three years. It defines American energy imports as imports of liquified natural gas (LNG), oil, and nuclear energy products and is intended to reduce EU dependence on Russian gas, oil, and nuclear imports as outlined by the EU’s REPowerEU plan. The details of the agreement are not yet finalized and are still subject to negotiation, so what explicitly qualifies as energy purchases and how the $750 billion will be allocated remains unknown. However, the information provided confirms that this deal could significantly reshape the global energy market.

Reshaping the Global Energy Market

If successful, this deal will substantially increase the EU’s recent expenditures on US energy. This is illustrated by comparing the deal’s expectations to the EU’s spending in previous years. In 2024, 50% of the EU’s $48 billion worth of LNG imports were from the US, according to Eurostat. The EU thus spent roughly $24 billion on US LNG. As for oil, about 17% of the EU’s $304 billion worth of petroleum oil imports were from the US. Therefore, the EU spent roughly $52 billion on US oil in 2024. According to the European Commission, US exports of nuclear fuel and fuel services in 2024 were worth roughly $813 million. In total, the EU spent roughly $77 billion on US LNG and oil in 2024, which falls near their estimated range of $90-100 billion per year. To meet the deal’s $250 billion per year requirement, the EU will need to increase its spending by roughly $173 billion more than it did last year.

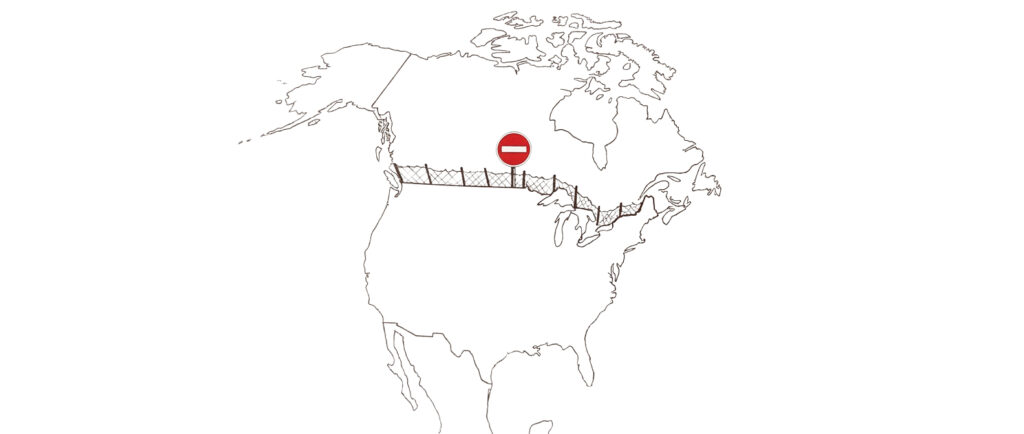

To spend this amount on US energy, the EU will have to abandon many of its current energy suppliers beyond Russia. In 2024, about 2.8% of total EU oil imports and 17% of total EU LNG imports were from Russia. Thus, redirecting all EU spending of Russian LNG and oil to the US only increases annual expenditures to roughly $94 billion, still about $156 billion short of the agreement. Accounting for Russian nuclear energy is negligible, as their imports of Russian uranium products in 2024 were only around $800 million. To prioritize US energy, the EU will have to discontinue energy partnerships in other countries, such as Algeria, Qatar, and Nigeria for LNG, and Norway, Kazakhstan, and Libya. Not only will suppliers in these countries find it increasingly challenging to compete for market share in Europe, but over-dependence on the US will leave the EU more susceptible to price fluctuations and supply chain issues. For example, LNG from Algeria, one of the EU’s largest LNG partners besides Russia, has a shorter transport route and is less impacted by severe weather, providing Europe with a more stable supply of energy. Sidelining suppliers like Algeria will restrict the EU’s capacity to secure alternative oil sources in the event of supply disruptions.

Beyond reshaping the EU’s import sources, the deal will require the US to prioritize its exports to the EU over other customers. Since US terminals already run at full capacity for energy, increasing shipments to the EU is not possible. For the US to supply $250 billion worth of energy, it will have to abandon exports to Asia and Latin America. This would cause major disruptions for top importers of US LNG, such as Japan, South Korea, and India, as well as major importers of US oil such as Mexico and China, who will be forced to seek alternate sources of energy. US energy, especially LNG, contributes significantly to the global market, diversifying many countries’ energy sources. This agreement could increase countries’ susceptibility to becoming dependent on a single or limited number of energy suppliers, posing stability concerns.

Geopolitical Consequences

Reshaping the global energy market could impact geopolitical dynamics, potentially pushing US and EU allies in the Global South into reliance on Russia and China. In recent years, China has leveraged weaknesses in the West’s relationship with the Global South to exert its own influence. By sidelining countries like Algeria, Qatar, Nigeria, and Libya, the EU will leave a vacuum in the Global South to be filled. In recent years, China has been one of the largest global importers of LNG, which will be exacerbated by the curtailment of the United States’ energy with China. Though Europe views itself as a “champion of multilateralism”, isolating itself so heavily with the US may damage trust with many countries. This could result in limited backing for their initiatives in international organizations, as seen in the widespread resistance to condemning Russia for its invasion of Ukraine in 2022.

Along with the EU, the deal could weaken the United States’ strategic partnerships with allies such as Japan, South Korea, and India. Though the deal will help the EU reduce its reliance on Russian energy, it can leave other US allies vulnerable to becoming more dependent on Russia. India, for example, has a strong economic and energy balance between Russia and the US. Abandoning India as a customer of LNG will give Russia the opportunity to replace the US as India’s main supplier, which it has already signaled in a recent statement from First Deputy Prime Minister Denis Manturov.

Looking Forward

While these potential implications are profound, many experts doubt they will be realized. At nearly three times the amount the EU spends on US energy per year, analysts argue that the $250 billion figure is far beyond what the EU will be able to realistically achieve. This uncertainty is exacerbated when considering that spending decisions are entirely reserved to companies that possess long-term contracts, further complicating a large-scale transition to US energy. Some experts have also expressed concern that the $250 billion threshold exceeds what the US can supply annually. In his analysis from Reuters, Clyde Russell reveals that even if the EU purchased all of the US’s exports of LNG and Crude Oil in 2024, they would still fall short of the spending threshold by about $100 billion. While the consensus is that it is unlikely the two can deliver the $750 billion commitment over the next three years, this deal still has the potential to strengthen US-EU energy partnerships. Shifts in the global energy market and geopolitical landscape may be observed, but likely in a more subtle fashion. Further clarity on whether this deal can be achieved, and its potential implications is anticipated as details of the agreement are released.

The images in this article were created using an AI image generator. All illustrations are ©Intelliwings.