China Set to Become World’s Top Auto Exporter by End Of 2023

| By Linyi Zheng |

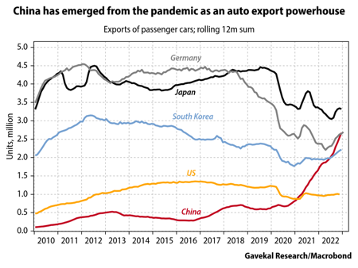

A surging demand for electric vehicles sent overall auto exports from China beyond the levels seen before the pandemic. According to data from the General Administration of Customs of the People’s Republic of China, in the first half of this year, China’s automobile exports were 2.34 million units, up 76.9% year-on-year. Among them, 795,000 new energy vehicles were exported, up 112.7% year-on-year, for China’s leap to the world’s largest auto exporter. In comparison, overall auto exports from Japan and Thailand — which include both traditional vehicles and EVs — have yet to see a return to pre-pandemic levels.

Total Exports Surging, But Brand Still Maturing

It should be noted that despite the increasing presence of Chinese automobile brands in the global market, their foothold is yet to be firmly established. While China’s total automobile exports have grown, their share in most markets remains limited and many Chinese brands are unable to compete with established European, American, Japanese, and South Korean brands. For instance, in the first half of this year, China exported around 350,000 new energy vehicles to Europe, which accounted for 25% of the market share. However, this figure is not indicative of strong sales by individual Chinese brands compared to multinational counterparts. Despite this, it is important to acknowledge the steady growth of the Chinese automobile industry and the potential for Chinese brands to gain a stronger foothold in the global market in the future.

Competitors Leverage Distributed Production

The international expansion of Chinese automobile companies has been met with significant challenges. Most Chinese automakers concentrate on local production, emanating from a single center and extending to the global market. Conversely, the old giants and multinational car companies are radiating outward from multiple centers, transforming overseas exports into overseas production. Japan serves as an example. In 1985, Japan’s automobile export volume amounted to 6.85 million units. However, in 2022, the export volume was 3.56 million units. Although the export volume appears to have decreased, Japanese cars accounted for 25.3% of global sales in 2022, ranking first worldwide. In the same year, Japanese car manufacturers produced 16.95 million units of vehicles overseas, while local production amounted to only 7.84 million units. This overseas production strategy has resulted in significant achievements.

Chinese Companies Aim to Expand Overseas Production

Chinese car companies are planning to accelerate their overseas production base layout. Several companies, including Great Wall, BYD, Chang’an, Nezha, and GAC EAN, are investing in building factories overseas. For instance, Chang’an Automobile is planning to build a new energy vehicle production base in Thailand. The purpose is to cater to the local Thai consumer demand and also export to other countries such as Australia, New Zealand, the United Kingdom, and South Africa. The companies aim to achieve the goal of “Chinese brand, global manufacturing; global brand, made in China” by expanding their overseas production and cross-border trade.

Photo Credit: Xinhua

Previous post

EW Defense Professionals Meet for AOC 2023

Previous post

EW Defense Professionals Meet for AOC 2023